Minimum_acceptable_rate_of_return

" Most companies use a 12% hurdle rate, which is based on the fact that the S&P 500 typically yields returns somewhere between 8% and 11% (annualized). Companies operating in industries with more volatile markets might use a slightly higher rate in order to offset risk and attract investors.

The hurdle rate is frequently used as synonym of cutoff rate, benchmark and cost of capital. Different organizations might have slightly different interpretations, so when multiple organizations (e.g., a startup company and a venture capital firm) are discussing the suitability of investing in a project"

Quote from - http://en.wikipedia.org/wiki/Minimum_acceptable_rate_of_return (MARR).

This is one of my source materials for answering the question what is the minimum ROR you try to achieve in your comic book investments?

So is 12% the minimum? If you look at it per year then do you calculate your profit in a virtual way based on "Book", "Ebay" or "Auction" value?

I have not explored this area to much and realize I need to. I believe everyone has a MARR but maybe does not express it or they just know it? Coming from a horse racing prospective, some people would be happy at 1% if they can Bet all the time (the churn). Other demand 20% or so but can wait for the exact spot for investing say once a day or week or month.

So it comes down to psychology. What can you live with? Which is personality but also bankroll dependent.

Answer these questions

1) Can I lose in 9 deals to win overall in my 10th deal?

2) Do need to make "money each time"?

3) If I make a bad deal or series of bad deals does that put me in a spiral?

4) Do I count my money everyday or once in 2 years?

Their are alot of book on these subjects. Suggest you seek your answers.

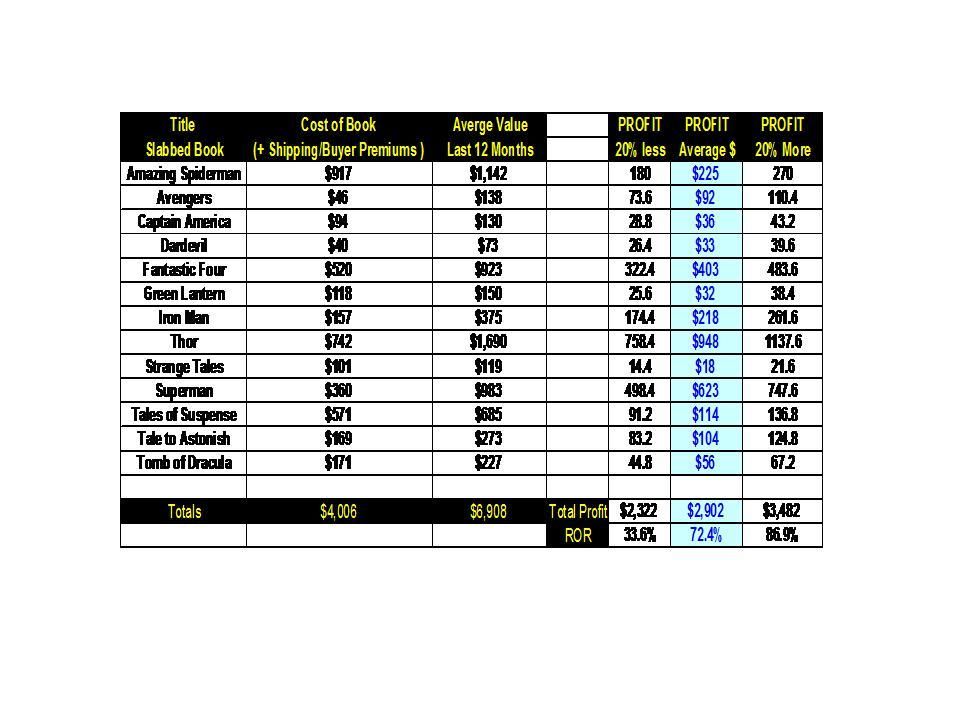

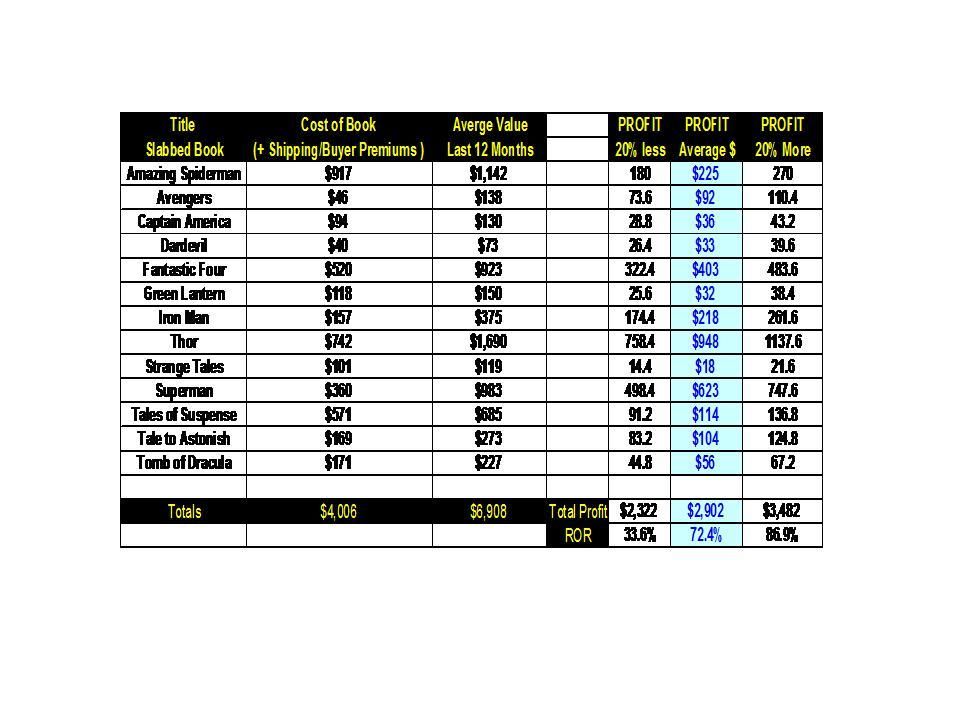

Here is my performance on slabbed comics since 2013.

Comments

Post a Comment