Investment Analysis of Adventure Comics #170 to 200. Interesting group of Comics.

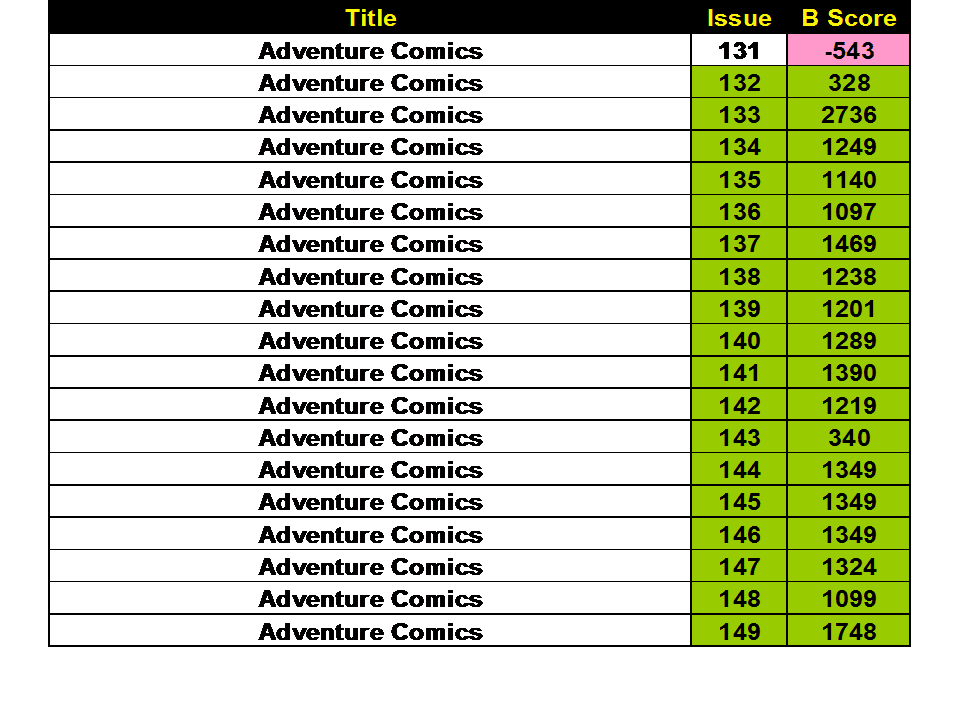

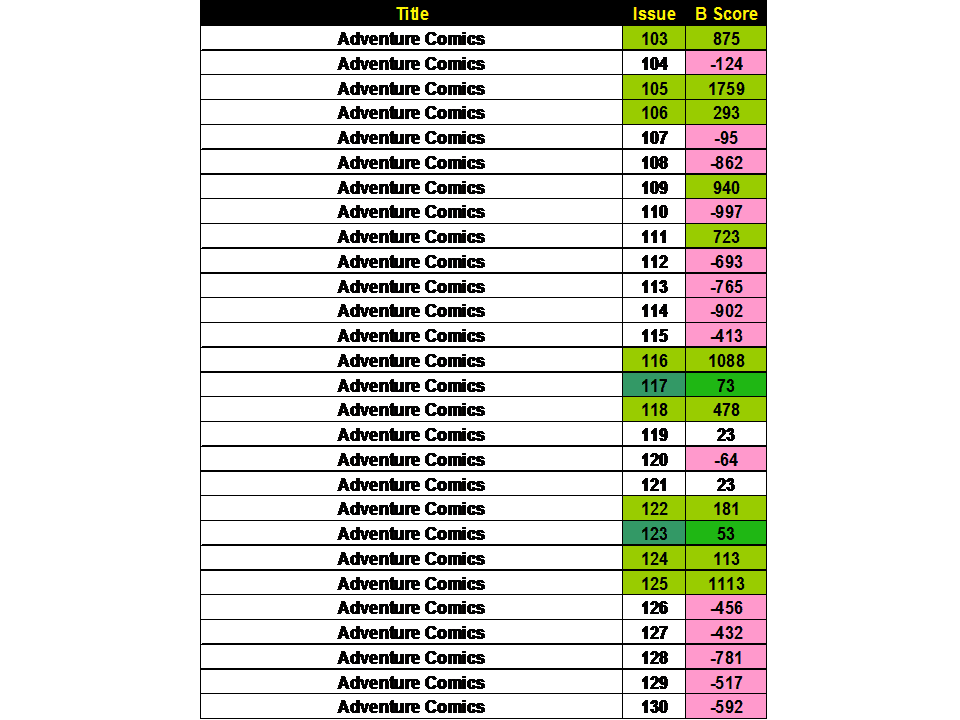

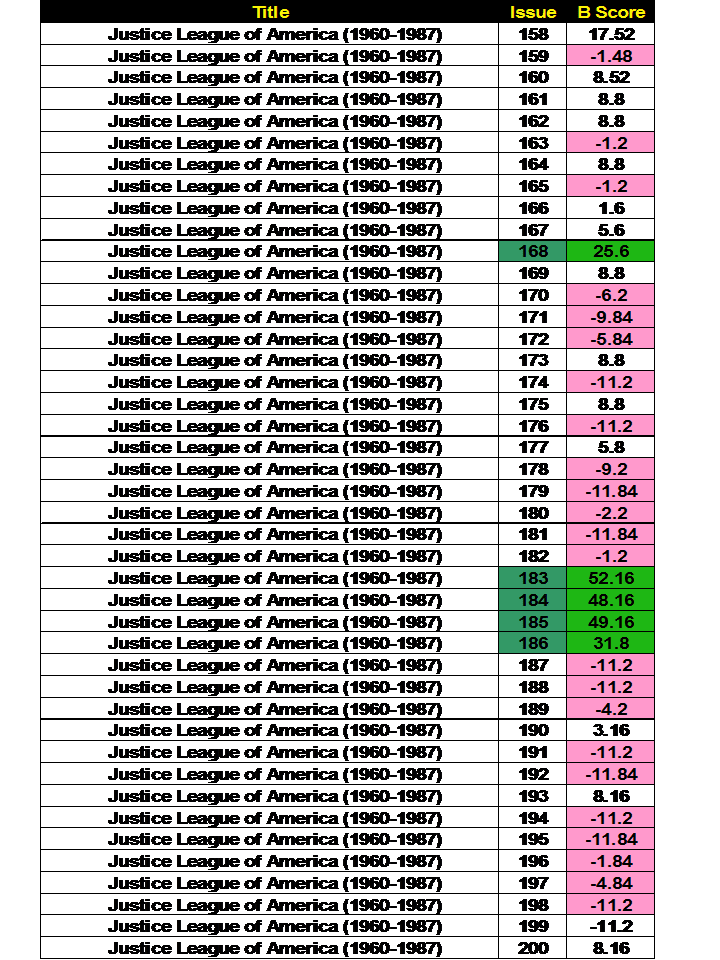

Investment Analysis of Adventure Comics #170 to 200 Nice Key Issues in here! These seem to be very collectible at 9.4 and above. I wonder when collectible desire takes a back seat to rarity? These issues inspire that question. How do we test that question? The first table presents the Bias Score (B Score) for all the issues. Bias scores show which issues are being bought by the Insiders (Pros) vs. the Outsiders (Fans Less Serious). The concept of my approach is to focus on the issues being bought BULLISHLY by the investors. We developed an analysis of data to quantify this Bias (B Score). We mark the issues with the highest Bias with Lime Green followed by a Dark Green staining for issues with a lesser but definite Bias. Red are those issues to avoid. Table 2 data deals with another data stream on comic-book issues. This run’s issues are looked at 3 grades 9.4, 8 and 6. The changes in bias between the different grades are calculated and the SLN numbers were born....