SECOND ARC BEGINS____ Investment Potential and Bias Analysis of Captain America Issues 100 to # 118

Amazingly Secret Approach Using an Incredibly Novel Data Analysis Procedure for Comic Book Investing and Speculation.

Analysis of Early Captain America Issues 100 to 118.

Analysis of Early Captain America Issues 100 to 118.

This is the beginning Blog Arc for the next group of Marvel

Titles to look at. I have eased over in the bronze era as well.

Captain America issues 100 to 118,

Sub-mariner 1 to 20, 22, 34 to 36 and 43.

Defenders 1 to 19,

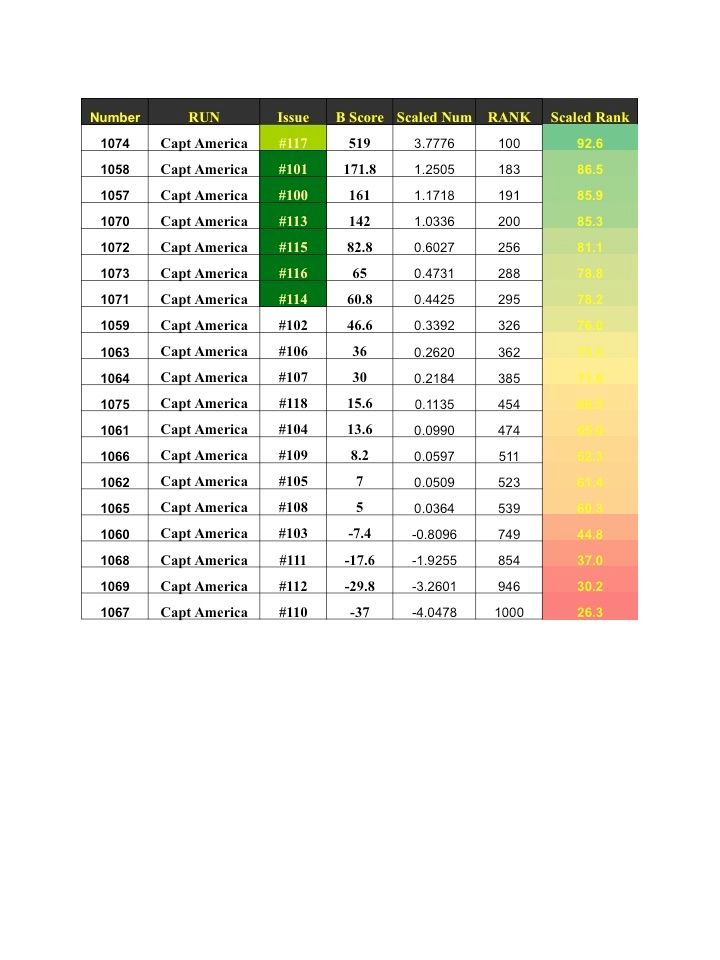

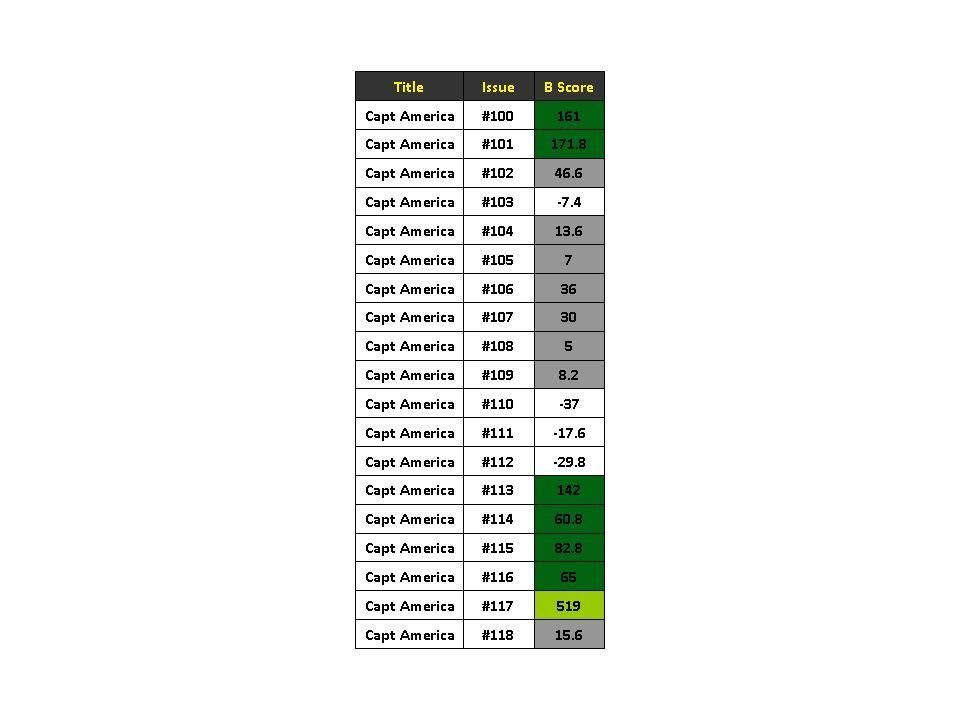

Iron Man 1 to 56,So given the interest in the recent movies, I suspected these issues would be strong buys. As discussed before the Bias Scores gives us a first top down view into these issues. Looking at table 1, green denoted issues are those issues biased supported by the insider investors and are recommended as buy candidates. The only light green issue #117 is the first appearance if the Falcon. Note its B Score is 519 that puts it in the top 85 silver age issues for desirability. That is a strong strong number. See the data in the Desire Scale Blog Post. I will be referring back to that to put context for you. The dark green denoted issues are 100, 101 and 113. Their B Scores place them out of the top groups. Note the negative and gray issues. Looks like some overbuying by the Outsiders here.

Table 1 the B Scores for CA #100 to 188

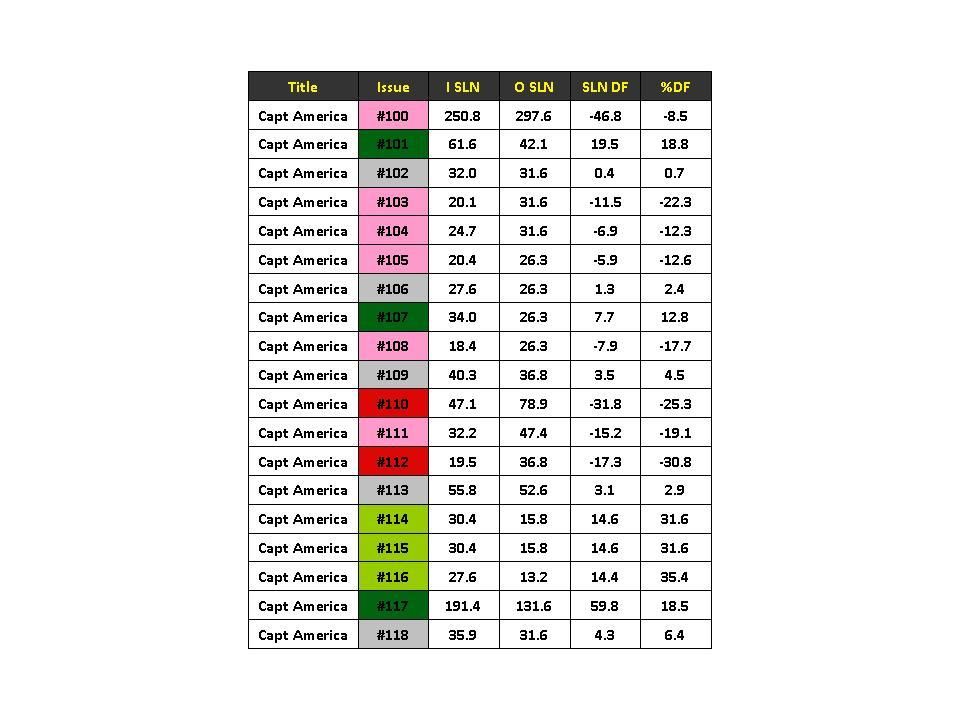

We now move deeper into our analysis. I use the SLN number

as a way to look across 3 grades of comic-book condition (9.4, 8 and 6) in each

Bias World. Insider’s SLN numbers

measure strength across the grades as seen by the insider investor. We compare the Insiders and Outsiders and get

a simple difference number (SLN DF) and get %DF for that issue. % DF measures

how much does that DF between represent of the total SLN numbers. For instance

in issue 100, %DF = (SLN DF/(I SLN + O SLN))*100 is -8.5% not a good score.

Negative numbers move the attention into the Outsiders camp. In Table 2, the green stained issues

represent strong differences and show the Insiders are favoring 101, 107, and

114 to 117. Red stained issues are the

opposite types and are pointing to avoid those issues. Gray stained issues are neutral signaled

issues and are on the watch list.

Table 2. SLN Numbers in these issues

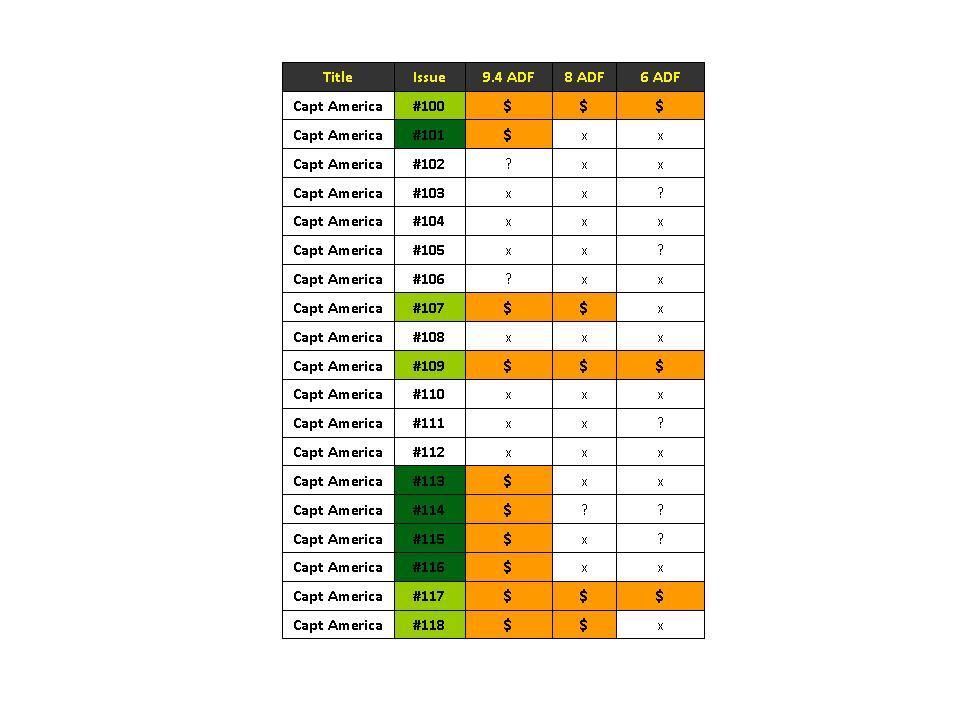

Ok next is hopefully the deep data we need to make final

conclusions. I generate the differences

not by I vs. O but by grades (9.4, 8 and 6). I have stained the Grade Grid with

$ (orange- favorite color) and stained I favored issues green with the light

green issues being the strongest I biased across multiple grades. Therefor

those issues are a buy across the 3 grades while the dark green ones are only

signaled as buys at the highest grade of 9.4. So the light green stained issues

(strong buy issues) are issues 100, 107, 109, 117, and 118. I am glad to see that issue 117’s data is

across the board here. About 60% of this run is a buy at 9.4 fyi. Please see

the blog advice on price points etc. for the complete story for investment

buying. I use this chart but have now

been adding the Score Card data as a “look across the landscape” view in this run

as well. See Table 4.

Table 3 the ADFs at grades 9.4, 8 and 6.

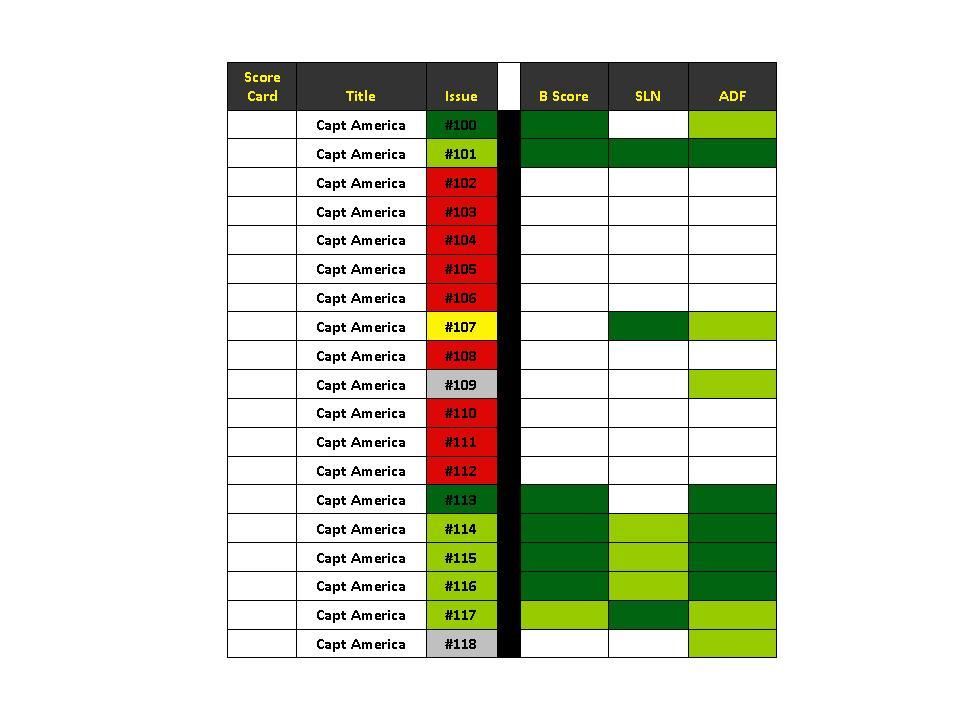

So looking at Table 4 the scorecard data gives me a big view

from above at the preceding data grids. I have stained the issues light green

for those issues favored across the 3 data streams, dark green for favored by 2

data streams and a grey points out issues favored only in one. Yellow are

interesting issues to watch. Red issues are not favored. I think 117 is the “got to buy” in this group

given the B Score and its Desire rating of 85 or so. You could be more generous with your price

points if you wish for this issue. The

others would be only considered under very favorable conditions (Good price to

buy). I would not reach for the rest of the greens unless you got to.

Table 4. Score Card for CA Issues #100 to 118.

So I have added some data I call the Desire Scale when I have groups 1356 issues and compared the Desire Level os each issue. I have included a Heat map of the Scaled Rank. Issue 117 is desired in the top 9% of all comics I have studied so far. So using the Scaled Num we can compare 2 issues 117 (3.77) vs 100 (1.17). Divide 3.77 by 1.17 and thus the Issue 117 is desired 3.2 times as much as Issue 100. Play with the data. Enjoy.

Table 5 Desire Scale for Captain America Issues.

Comments

Post a Comment