Investment Potential and Analysis of Batman 100 to 139

*** We will be moving to the World of DC comics Silver Age for awhile. ***

*** We will be posting every 7 days and see how that goes.**

Next 5 Blog Posts every 7 days will be these below:

Investment Potential and Analysis of Batman 140 to 171 On 8/26/15

Investment Potential and Analysis of Batman 140 to 171 On 8/26/15

Investment Potential and Analysis of Batman #172 to 200 On 9/02/15

Investment Potential and Analysis of Batman 201 to 262 On 9/09/15

Investment Potential and Analysis of Batman 263 to 608

Assorted Issues Only On 9/16/15

Investment Potential and Analysis of Superman 102 to 130 On 9/23/15

Investment Potential and Analysis of Batman 100 to 139

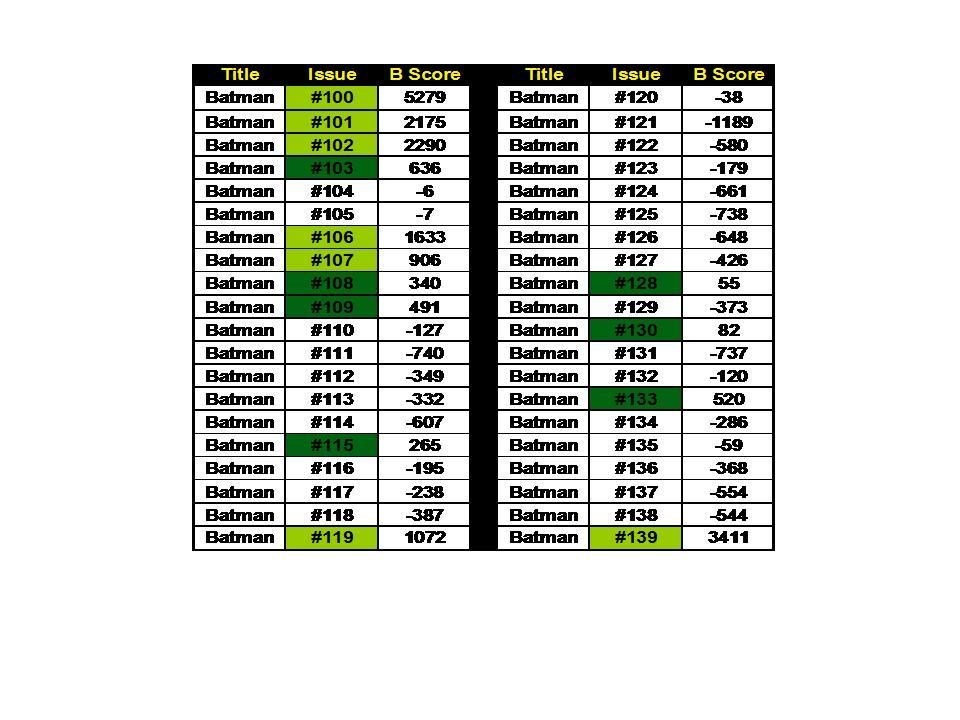

The first Table presents the Bias Score for all the issues. Bias scores show which issues are being bought by the Insiders (Pros) vs. the Outsiders (Fans Less Serious). The concept of my approach is to focus on the issues being bought BULLISHLY by the investors.

We developed an analysis of data to quantify this Bias (B Score). We mark the issues with the highest Bias with Lime Green followed by a Dark Green staining for issues with a lesser but definite Bias.

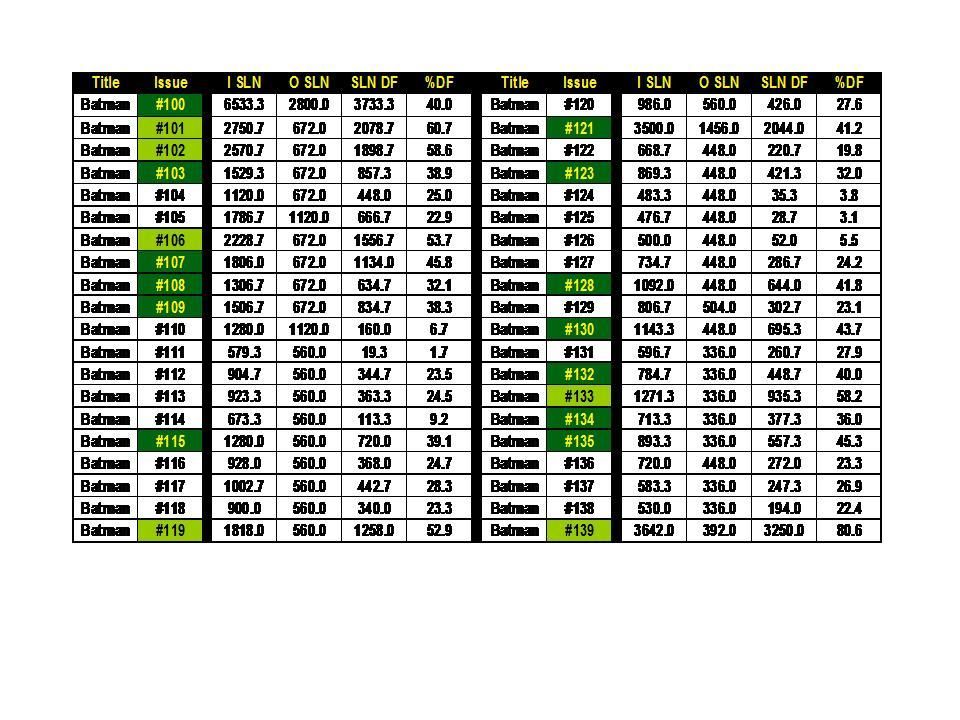

Table 2 data deals with another data stream on comic-book issues. This run’s issues are looked at 3 grades 9.4, 8 and 6. The changes in bias between the different grades are calculated and the SLN numbers were born. The SLN numbers look into each “world” of the I vs. O bias data. This data has shown historically to be the most liberal and establishes the investment potential across the grades of 9.4, 8 and 6. Very quickly, the green stained are positive issues and red stained issues are a negative and invite a non-focus in only investments

We then compare those SLN numbers and generate a difference number we call the DF. Finally add the I and O SLN numbers together (total) and determine the %DF number for each issue. Green staining is good (Higher Bias) and Grey and Red are issues that are not good for an investment focus. This data stream is more liberal in the rigor and you get the best case for an issue,

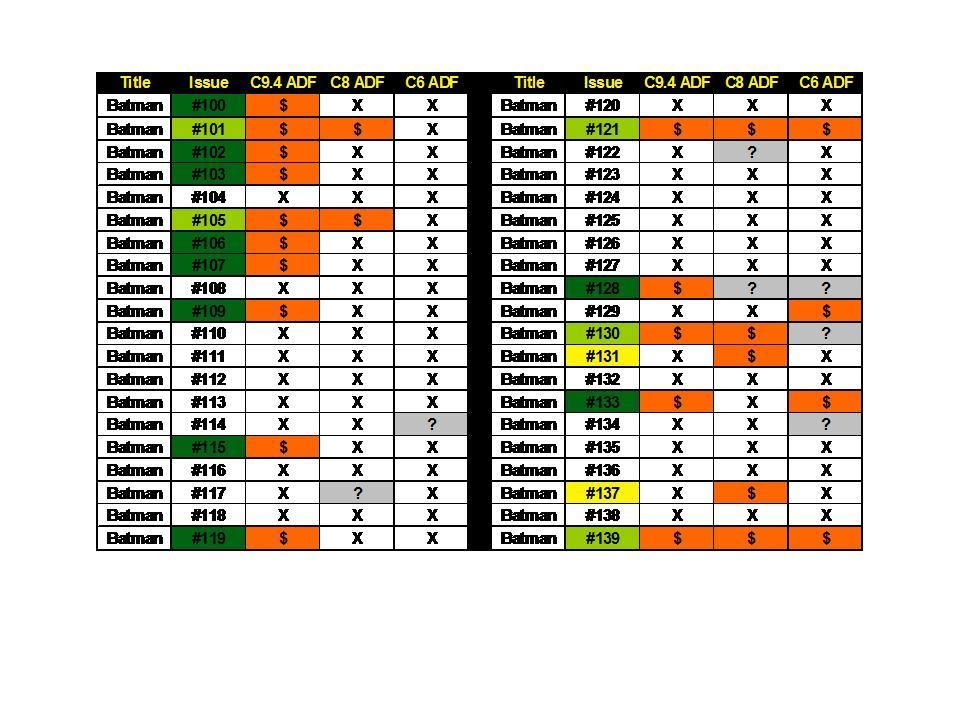

The deepest level of analysis we developed is the ADF number (average difference between the I/O worlds) of each issue at each grade. I denote a high I Bias with the orange $.

Lime green stained issues are rated I Biased in all grades or at least 9.4 and 8. Dark green stained issues are only biased at the 9.4 grade while the other grades are overbought relative to the professional investor’s desires.

Table 3 is the stricter data stream and highlights both the issue and grade. We calculate the average difference (ADF) in Issue Bias between the Insider and Outsiders groups. Lime Green are issues that are I Biased at least 9.4 and 8 grades (High Bias). (Orange $). The dark green issues are support with a Bias in 9.4 grade only. The other issues are to be avoided.

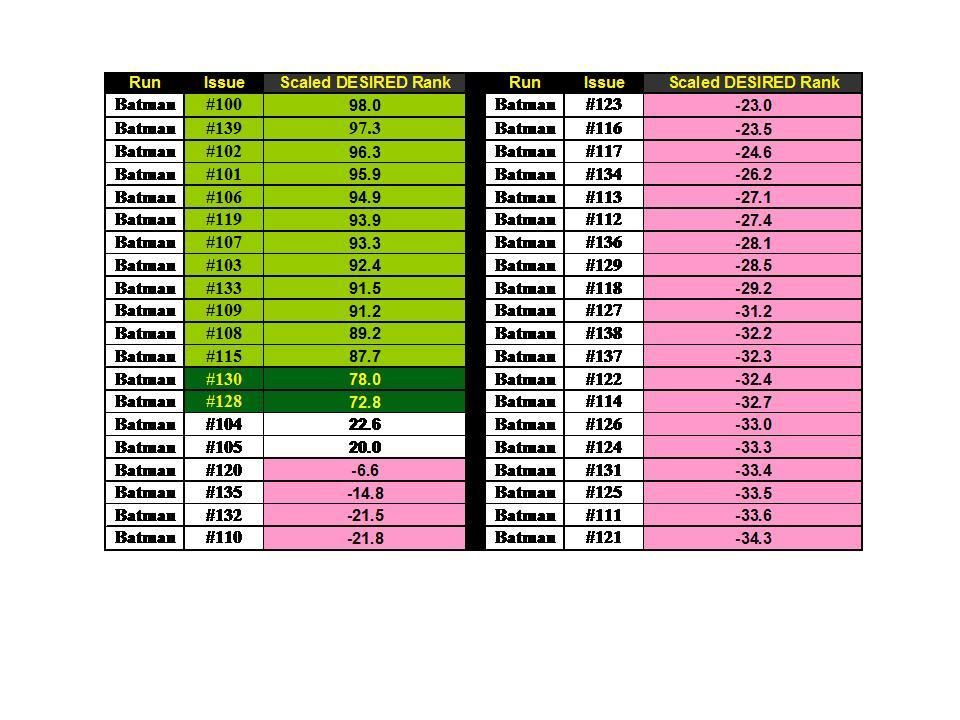

Table 4 is the Score Card information for each issue at the 3 data streams. This allows a top down view across the data streams. We denote the issues supported in all three data streams with a Lime Green staining. Dark Green has only 2 data streams support and yellow issues are supported in one data stream only.

Table 5 is the last bit of data, the Scaled Desire Ranking. I have grouped 1356 issues of comics that I have covered and developed scaled desire rankings. The percentile that an issue occupies gets wonderful insight into true value between titles. So we position our title and its key issues in context. A score of 99 means that comic issue is desired at the highest level while 1 percentile is the lowest desired issue.

So we begin our journey into the Silver Age DC Starting with Batman 100 to 139. So seen in Marvel this age is the home to many values for investment focus. Some have argued that the rarity is greater in silver age key DC vs Marvel. Interesting. So we would expect high levels in issues desired then? As we go through keep watch on the big picture.Table 1 Bias Score.

So we see the issues of 100 to 102, 106 to 7, 119 and 139 Batman are stained lime green which means high desirability. Issues 103 108,109,115,128,130, and 133 are as issues on our watch.

So issues noted in fandom!

Batman #105 1st Batwoman in Batman series 2nd appearance of Batwoman anywhere

Batman #121 First appearance of Mr. Freeze Origin of Mr. Freeze

Batman #129 Origin of Robin retold Batwoman appearance

Batman #139 1st appearance

original Bat-Girl Intro Betty Kane

We would focus on our defined issues. We agree on 139 however.

We continue into our look here and see 101,102 106,119, 133 and 139 are the strongest issues looking by this data stream. Note 121 is noted but still not 105 and 121.

Use our deepest look see finally see 101, 105 and 139 are the main ones for focus below 9.4 only. Clearly 139 is the big issue is this group and is a must focus.

The score card notes the issues found by the most data streams. All 3 data streams see 100 to 103, 106, 107 109, 115,119,128,130,133 and 139. Note 121 shows up in 2 data streams with 108. I would only focus on those issues.

Finally to place the issues onto our desire scale we see 12 issues about 87%. Strong focus is recommended. Note 100 and 139 are above 97%. Nice! not the low issues in red. very amazing. I see this shows DC have less strength than marvel. See these older comics being not desired was surprising and I suspect one must only focus and strong issues. I marvel silver age, I am able to fish on less strong and do well. I routinely buy on marvel but wanted to look in the DC world. This concerns me! I am going to be very cautious. I suggest you are so as well.

Comments

Post a Comment