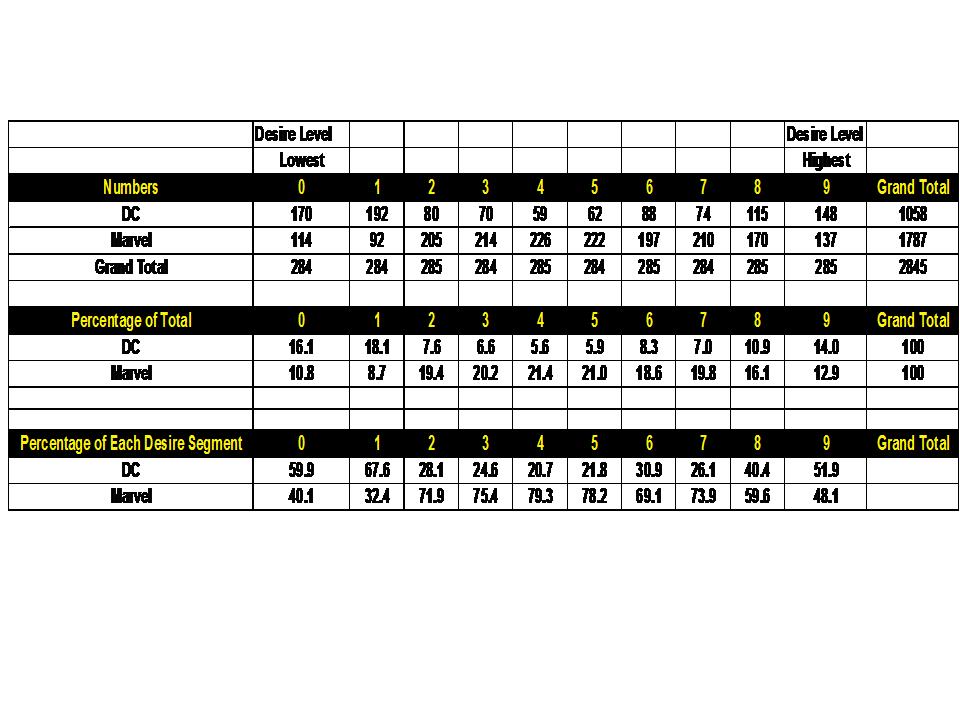

2845 Silver Age Comics. Look at DC vs Marvel Comics Distribution Across the Desire Scale

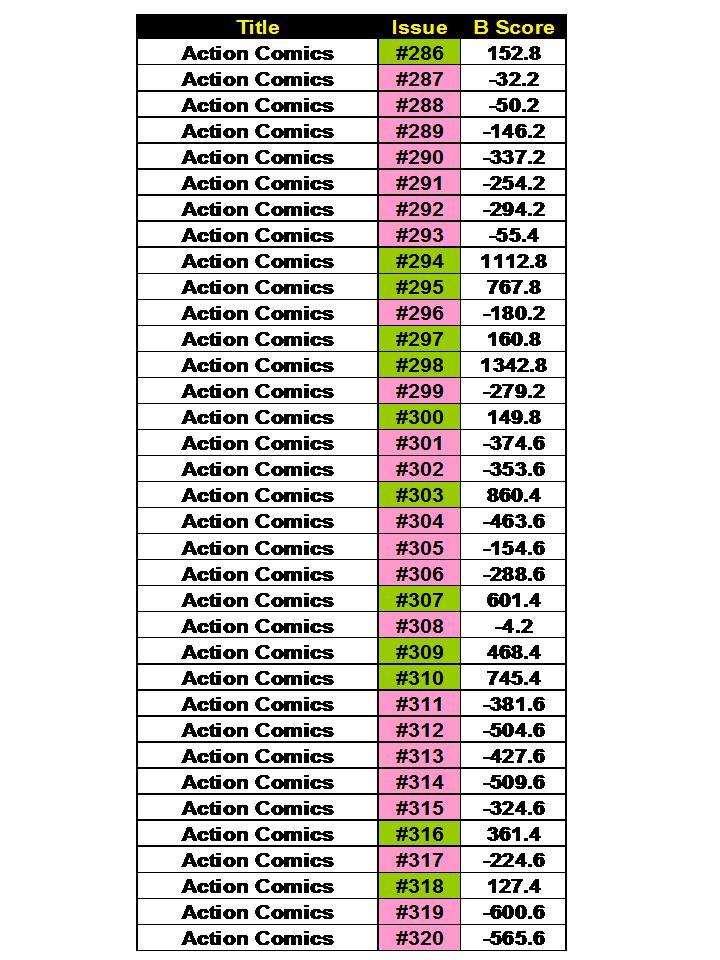

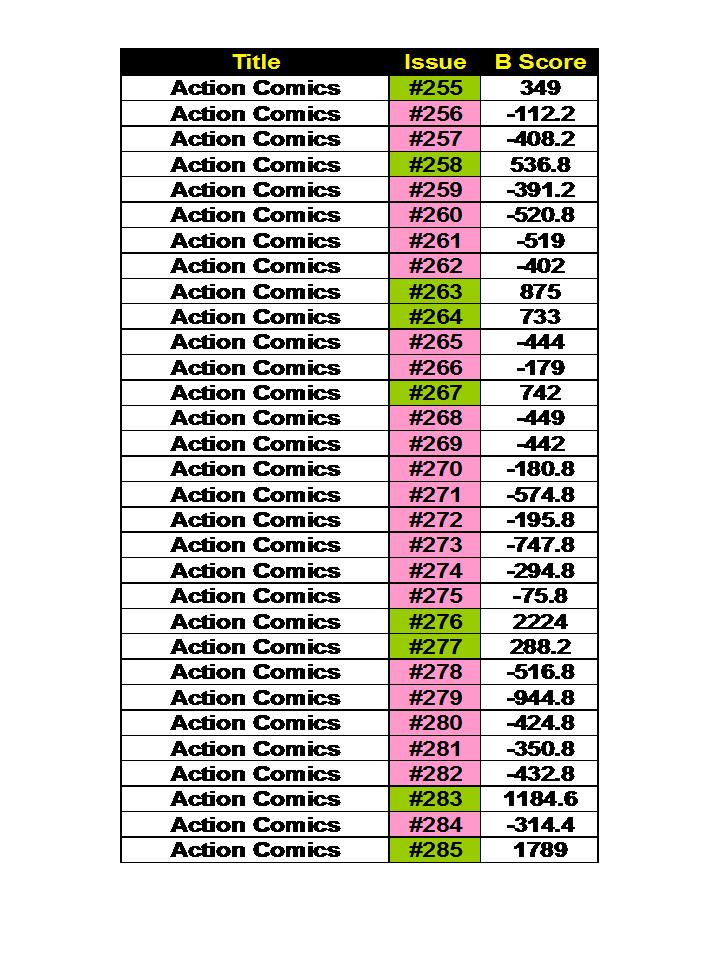

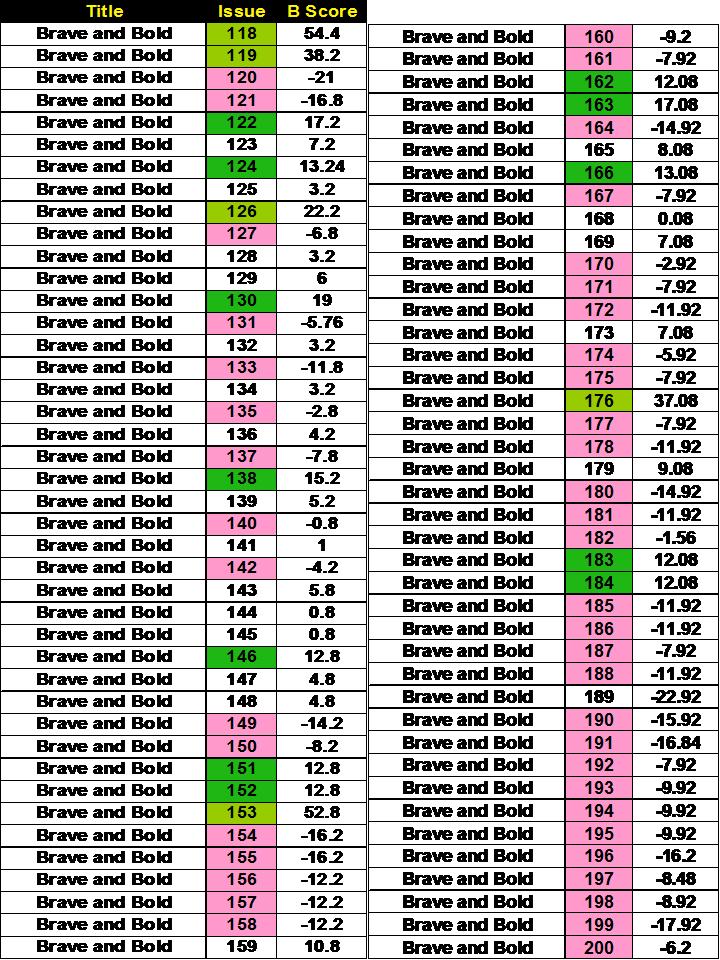

2845 Silver Age Comics. Look at DC vs Marvel Comics Distribution Across the Desire Scale As a result of my analysis, I am able to estimate each comic book issue's desirability. As seen elsewhere the raw numbers are not normalized distributed. (see 12/20 post). I do a numerical transformation to approach a more normalized set of data. So I wish to ask a simple question. "Are the comic books from Marvel and DC the same in their distributions across the desirability scale from low to high?" Figure 1 presents the actual raw number of all my database divided by the desirability segments (0 = 0 to 9.99% desirable all the way to the top segment of 9 = 90.0% to 100% desirable) Figure 2 is a plot of the % of each comic-book company's comics across each segment. Figure 3 is a plot of the % of each comic-book company's comics within each segment. I conclude that the investment potential is very different! Collector must be aware of this! I in